Understanding WPC Wall Panel HSN Code for Importing

Understanding WPC Wall Panel HSN Code for Importing When it comes to importing materials, especially in the construction and interior design sectors, understanding the relevant HSN (Harmonized System of Nomenclature) codes is crucial. One such material that has gained popularity in recent years is WPC (Wood-Plastic Composite) wall panels. These panels are increasingly favored for…

Understanding WPC Wall Panel HSN Code for Importing

When it comes to importing materials, especially in the construction and interior design sectors, understanding the relevant HSN (Harmonized System of Nomenclature) codes is crucial. One such material that has gained popularity in recent years is WPC (Wood-Plastic Composite) wall panels. These panels are increasingly favored for their aesthetic appeal, durability, and sustainable properties. However, navigating the complexities of importing such materials requires a clear understanding of their HSN code, as this plays a significant role in customs duties, taxes, and overall import regulations.

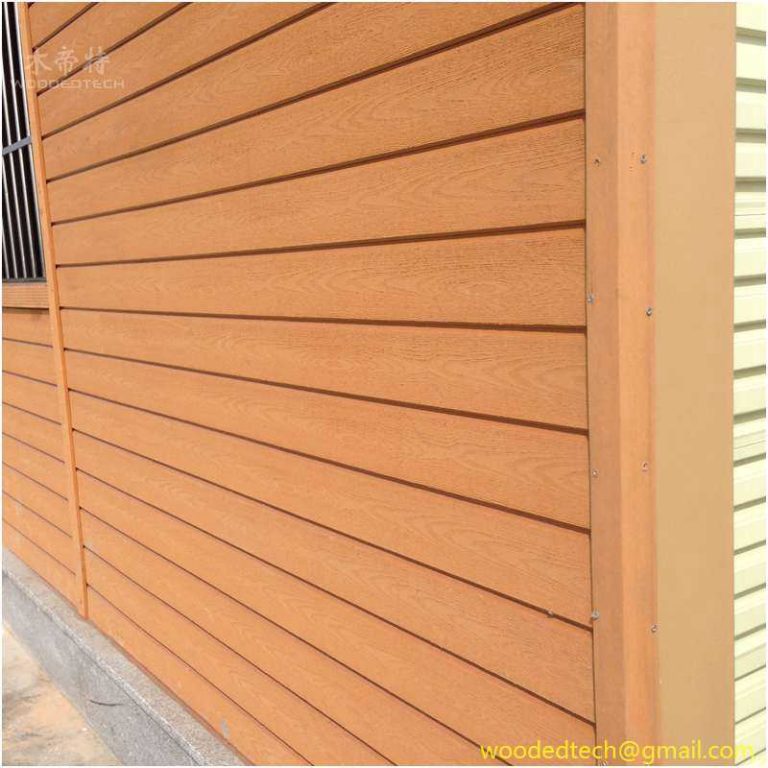

WPC wall panels are a composite material made from a blend of wood fibers and plastic. This combination grants them unique properties that set them apart from traditional materials. WPC panels are resistant to rot, moisture, and insects, making them ideal for various applications, including exterior cladding, interior wall coverings, and even furniture. Their versatility extends to both residential and commercial settings, where they can enhance aesthetics while providing functional benefits.

Understanding the HSN code for WPC wall panels is vital for any importer. The HSN code system is a globally standardized numeric classification system for goods. It allows for the systematic categorization of products for customs purposes, ensuring that taxes and tariffs are applied correctly. For WPC wall panels, the HSN code typically falls under a specific classification that reflects their composite nature.

The HSN code for WPC products generally starts with a broader category related to plastics and their derivatives. This is because WPC is fundamentally a plastic product, albeit with wood components. The exact HSN code can vary based on the specific formulation of the WPC, the intended use of the panels, and the regulations of the importing country. It is essential for importers to consult the latest customs regulations or engage with customs brokers to ascertain the correct HSN code for their specific products.

Once the correct HSN code is identified, importers can proceed with their shipping and customs clearance processes. Knowing the HSN code also helps importers understand the associated customs duties and taxes. Different products can attract varying rates, and having precise information can lead to significant cost savings. Importers must keep abreast of any changes in tax structures or trade agreements that could affect the importation of WPC wall panels.

Another critical aspect of importing WPC wall panels is compliance with quality standards and regulations of the destination country. Many countries have specific guidelines regarding building materials, especially those that may impact health and safety. Importers should ensure that their products meet local regulations, which might include certifications for fire resistance, toxicity, and environmental impact. This ensures not only compliance but also the safety and satisfaction of end-users.

Sustainability is another key consideration in the importation of WPC wall panels. As consumers become increasingly eco-conscious, the demand for sustainable building materials continues to rise. WPC panels are often marketed as environmentally friendly due to their composite nature—utilizing recycled plastic and wood fibers reduces waste and conserves natural resources. Importers can leverage this aspect in their marketing strategies, highlighting the sustainability credentials of their products to appeal to environmentally aware consumers.

In addition to sustainability, the versatility of WPC wall panels is a significant selling point. They can be manufactured in various colors, textures, and finishes, providing designers and architects with a wide array of options for their projects. This adaptability not only caters to aesthetic preferences but also aligns with various design trends, whether modern, rustic, or minimalist. Importers should be aware of these trends, as they can influence purchasing decisions and market demand.

Furthermore, the installation process for WPC wall panels is relatively straightforward compared to traditional materials. This ease of installation can be a selling point for contractors and builders, as it can lead to reduced labor costs and faster project timelines. Importers can benefit from promoting the practical advantages of WPC wall panels, emphasizing their user-friendly nature, which can be a deciding factor for many buyers.

Another important consideration for importers of WPC wall panels is the logistics involved in shipping and handling. Given their composite nature, WPC panels may require specific storage and handling conditions to prevent damage during transport. Importers must ensure that their suppliers adhere to best practices in packaging and shipping to maintain product integrity. Moreover, understanding the logistics of importing can help mitigate delays and unforeseen costs.

In conclusion, the importation of WPC wall panels involves various considerations, with understanding the HSN code being paramount. This code not only influences customs duties and taxes but also affects compliance with local regulations and quality standards. As the market for sustainable and versatile building materials continues to grow, importers must stay informed about trends, logistics, and consumer preferences. By doing so, they can position themselves effectively within the market and meet the evolving demands of the construction and design industries. Whether for residential or commercial applications, WPC wall panels represent a compelling choice that combines functionality with aesthetic appeal, making them a valuable addition to any importer’s product lineup.