Get the WPC Panel HS Code for Your International Shipping Needs

Get the WPC Panel HS Code for Your International Shipping Needs When engaging in international trade, understanding the classification of your products is paramount. One such product that has gained significant traction in recent years is the Wood Plastic Composite (WPC) panel. These panels are renowned for their durability, versatility, and eco-friendliness, making them an…

Get the WPC Panel HS Code for Your International Shipping Needs

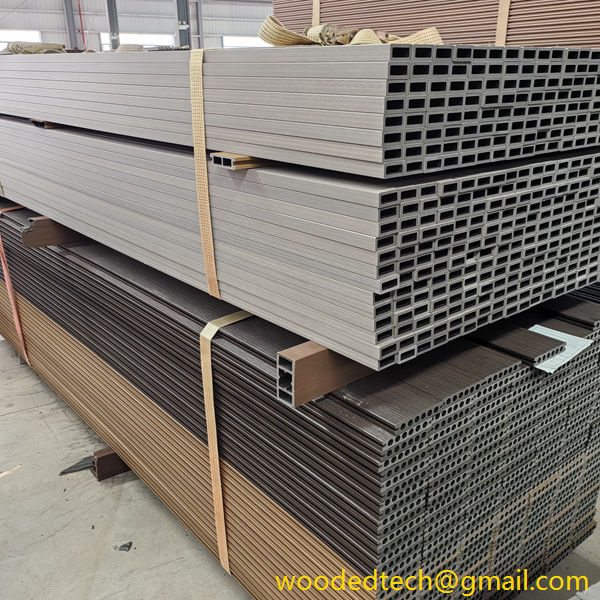

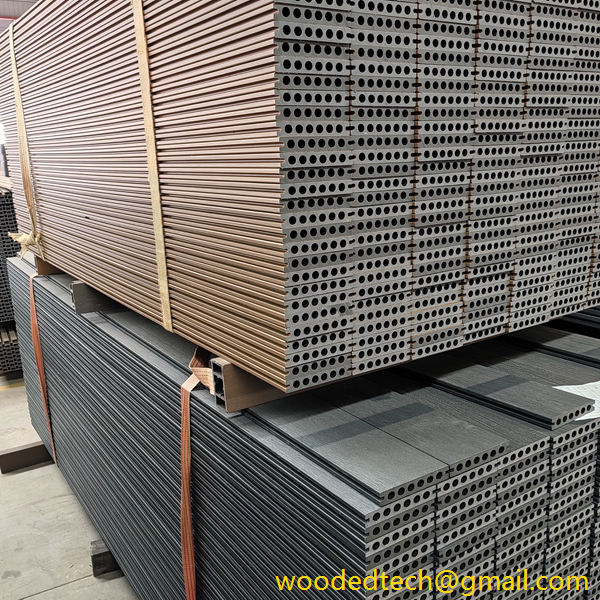

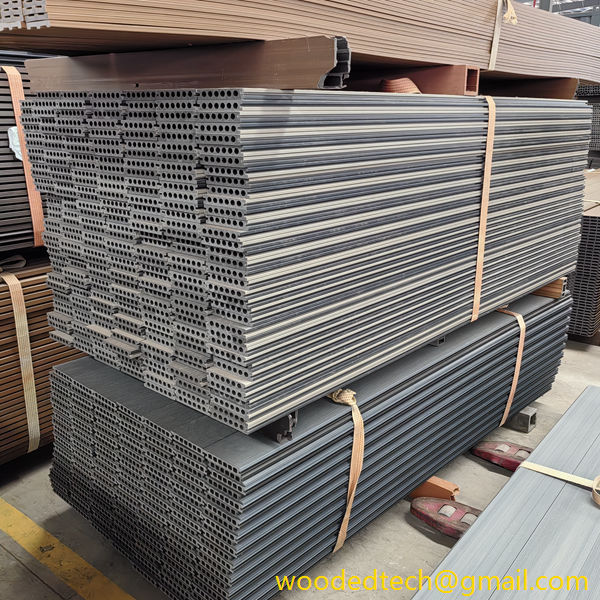

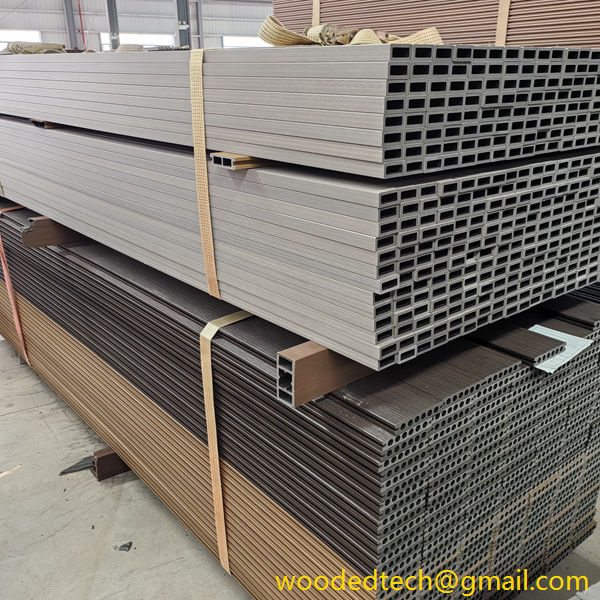

When engaging in international trade, understanding the classification of your products is paramount. One such product that has gained significant traction in recent years is the Wood Plastic Composite (WPC) panel. These panels are renowned for their durability, versatility, and eco-friendliness, making them an attractive choice for various applications, including construction, furniture, and decorative items. However, to facilitate smooth international shipping, it is essential to determine the correct Harmonized System (HS) code for WPC panels.

The Harmonized System is an internationally standardized system of names and numbers that classifies traded products. It was developed by the World Customs Organization (WCO) and is used by customs authorities around the world to assess duties and taxes. Each product is assigned a unique HS code, which can be crucial for ensuring compliance with customs regulations and facilitating the process of international shipping.

WPC panels, which are made from a mixture of wood fibers and plastic, are classified under specific HS codes based on their composition and intended use. Generally, these codes fall under Chapter 39 (Plastics and articles thereof) or Chapter 44 (Wood and articles of wood). The exact classification may depend on various factors, including the proportion of wood fibers to plastic, the type of plastic used, and the final application of the panels.

To identify the correct HS code for WPC panels, it is essential to consider several factors. The first step is to analyze the composition of the WPC panels. If the panels contain a higher percentage of wood fibers, they may be classified under Chapter 44. Conversely, if the plastic component predominates, Chapter 39 may be more appropriate. Furthermore, specific formulations and additives used in the production of the panels can influence their classification.

Once the composition is determined, it is advisable to consult the customs tariff of the importing country. Each country may have its own interpretation of the HS codes and may classify WPC panels differently. Therefore, it is crucial to obtain accurate and country-specific information to avoid potential delays or complications during the shipping process.

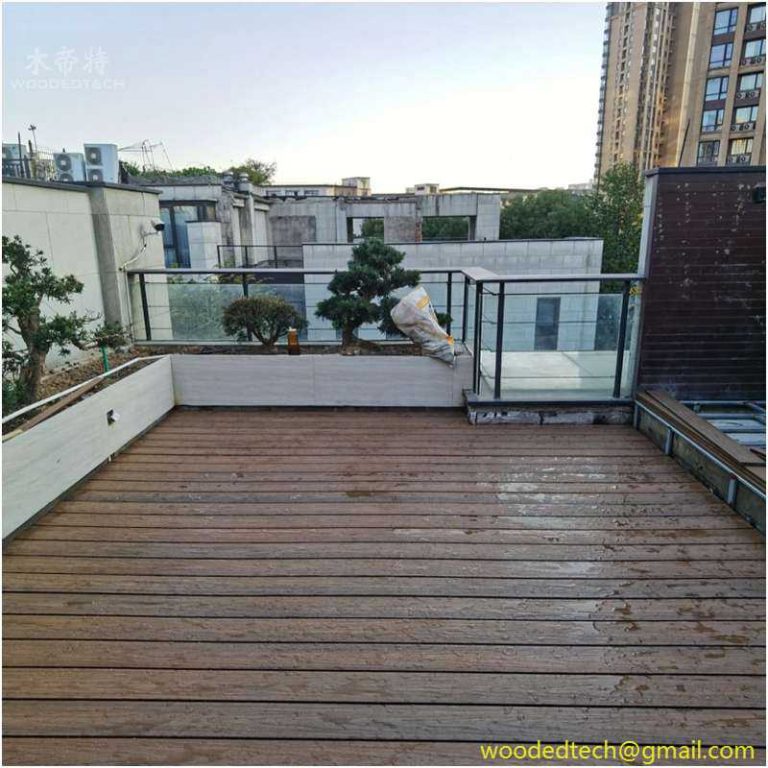

In addition to composition and country-specific regulations, the intended use of the WPC panels plays a significant role in determining their HS code. For instance, if the panels are designed for outdoor use, such as decking or fencing, they may fall under a different classification than panels intended for indoor applications like furniture or wall cladding. Understanding the end-use of the product can help streamline the classification process.

Another important aspect to consider is the potential need for additional documentation when shipping WPC panels internationally. Certain countries may have specific regulations regarding the import of composite materials, particularly concerning their environmental impact and sustainability. For example, some countries may require proof that the wood fibers used in the WPC panels are sourced from sustainably managed forests. This documentation can include certificates of origin, compliance with international regulations, and other relevant paperwork.

Furthermore, understanding the customs procedures for importing WPC panels can significantly impact your international shipping experience. In many cases, customs authorities will require detailed information about the product, including its composition, intended use, and HS code. Having all necessary documentation prepared in advance can help expedite the customs clearance process and prevent unnecessary delays.

The significance of accurately determining the HS code for WPC panels cannot be overstated. Incorrect classification can lead to miscalculations of duties and taxes, potential fines, and even the rejection of goods at the border. Therefore, it is advisable to seek the assistance of customs brokers or trade experts who can provide guidance on classification and compliance issues.

As the demand for sustainable building materials continues to rise, WPC panels are likely to see increased usage across various industries. Their unique properties, including resistance to moisture, insects, and decay, make them an ideal choice for both indoor and outdoor applications. However, as with any product in international trade, proper classification and compliance are essential for successful market entry.

In conclusion, obtaining the correct HS code for WPC panels is a critical step in the international shipping process. By analyzing the composition, intended use, and relevant regulations, businesses can ensure that their products are classified accurately. This attention to detail not only facilitates smoother customs clearance but also enhances overall efficiency in international trade. As the market for WPC panels continues to grow, understanding the intricacies of HS code classification will be increasingly important for manufacturers and exporters looking to capitalize on global opportunities.