Find the WPC Panel HSN Code for Easy Import and Export

Find the WPC Panel HSN Code for Easy Import and Export When it comes to the import and export of materials in today’s global marketplace, understanding the Harmonized System Nomenclature (HSN) codes is crucial. HSN codes are internationally recognized codes used to classify products and goods for custom duties and taxes. These codes help streamline…

Find the WPC Panel HSN Code for Easy Import and Export

When it comes to the import and export of materials in today’s global marketplace, understanding the Harmonized System Nomenclature (HSN) codes is crucial. HSN codes are internationally recognized codes used to classify products and goods for custom duties and taxes. These codes help streamline the customs process, making it easier for businesses to import and export products efficiently. One such product that has gained significant popularity in recent years is Wood Plastic Composite (WPC) panels. This article will delve into the importance of finding the correct HSN code for WPC panels, especially for those engaged in international trade.

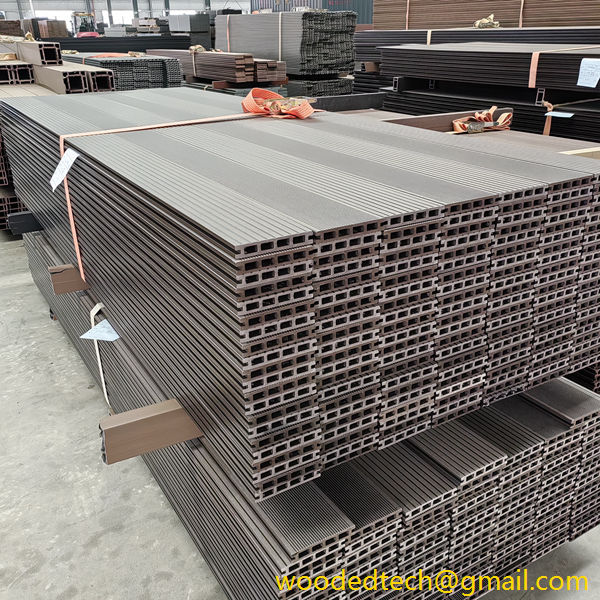

WPC panels are innovative building materials made from a combination of wood fibers and plastic. They offer the aesthetic appeal of wood while providing the durability and weather resistance of plastic. These panels are extensively used in various applications such as flooring, wall cladding, furniture, and outdoor decking. Given their versatility and eco-friendly nature, WPC panels have become a preferred choice for architects, builders, and homeowners alike.

Before engaging in import or export activities involving WPC panels, it is essential for businesses to identify the correct HSN code. The HSN code serves as a universal language for customs authorities worldwide, facilitating smoother transactions and ensuring compliance with international trade regulations. The code specifically assigned to WPC panels can vary depending on the composition, use, and other factors associated with the product.

To find the appropriate HSN code for WPC panels, businesses should consult the latest version of the HSN classification system. This system is periodically updated to accommodate new products and industry advancements. It is advisable to refer to the official customs department website or a reliable trade resource to access the most accurate and up-to-date information.

When searching for the HSN code for WPC panels, it is important to consider the specific features of the product. For instance, if the WPC panel is used for construction purposes, it may fall under a different category compared to those used for decorative applications. Additionally, the percentage of wood and plastic in the composite material can also influence the classification. Therefore, businesses must be diligent in providing detailed product descriptions to ensure they are assigned the correct HSN code.

Once the correct HSN code is identified, businesses can proceed with the import and export process with greater confidence. Having the right code simplifies documentation requirements and helps avoid potential delays at customs. It also aids in calculating applicable duties and taxes, allowing businesses to budget more effectively for their international transactions.

Moreover, accurate HSN coding is vital for compliance with international trade agreements. Many countries have specific regulations regarding the import and export of composite materials, particularly those that may have environmental implications. By using the correct HSN code, businesses can demonstrate their commitment to adhering to these regulations, fostering trust and credibility in their operations.

In addition to facilitating compliance, the correct HSN code can also affect market access. Different countries may impose different tariffs on various categories of goods. By ensuring that WPC panels are classified correctly, businesses can take advantage of preferential trade agreements that may reduce or eliminate tariffs, ultimately making their products more competitive in foreign markets.

Furthermore, having the right HSN code can enhance visibility and traceability in supply chains. In an increasingly interconnected global economy, consumers and businesses alike are demanding greater transparency regarding the origins of products. Accurate classification allows businesses to provide verifiable information about their materials, contributing to a responsible and sustainable supply chain.

In conclusion, understanding and finding the correct HSN code for WPC panels is essential for businesses involved in the import and export of these innovative materials. With the growing popularity and diverse applications of WPC panels, ensuring accurate classification can lead to smoother customs processes, compliance with international regulations, and enhanced market access. As the global marketplace continues to evolve, staying informed about HSN codes and other trade regulations will be crucial for businesses looking to thrive in the competitive landscape. By taking the time to research and identify the appropriate HSN code, companies can optimize their international trade practices and position themselves for success in the ever-changing world of commerce.